In a nutshell, DeFI stands for Decentralized Finance.

For all of modern society, we have only known Centralized Finance, which is when a central authority regulates the movement of money.

These central authorities are usually the government and the banks. They don’t say it explicitly, but they do control all our money.

If they want to, they can print more of it. If they don’t want you to borrow it, they can prevent you from doing so. They have the power to prevent you from having a bank account at any time. They might even be able to get their hands on your money, and freeze it for example.

They have your money and can change it, and you can’t really argue with that. They can also limit what you can do if you run a business.

For example, if you have a little ‘therapeutic plant’ business, they can order you not to take any of the money from the business to the bank, severely limiting your financial options. It implies you can’t put it in a bank, invest it, or simply keep it secure.

Traditional banking can also be very costly. Payday loans can cost up to 500 percent of your income, credit cards can cost up to 25%, and personal loans can cost up to 18% of your income. Despite the high fees, repayment is mandatory.

What then is Decentralized Finance (DeFI)

Decentralized finance, is a system in which no banks exist. It is an alternative to centralized finance, now made possible by the blockchain.

Instead for a few authorities, there are code modules that run and function like a bank. Anyone is welcome to join. Because they’re just a piece of code executing a program, they don’t require you to trust them. You could even study them and verify that there is no fraud happening, unlike banking whose rules and procedures are often inaccessible to us.

They’re also unaffected by censorship, and are significantly less expensive than traditional centralized finance.

Driving decentralized finance are 3 technologies:

- Cryptography:- The science of secure communications techniques that allows only the sender and intended recipient of a message to view its contents.

- Blockchain:- A system in which a record of transactions are maintained across several computers that are linked in a peer-to-peer network.

- Smart Contracts:- Blockchain programs that run when predetermined conditions are met

How Does DeFi Work?

To understand everything about Decentralized Finance, let’s look at five pillars essential to its working.

The 5 pillars of Decentralized Finance (DeFi)

1. Stablecoins

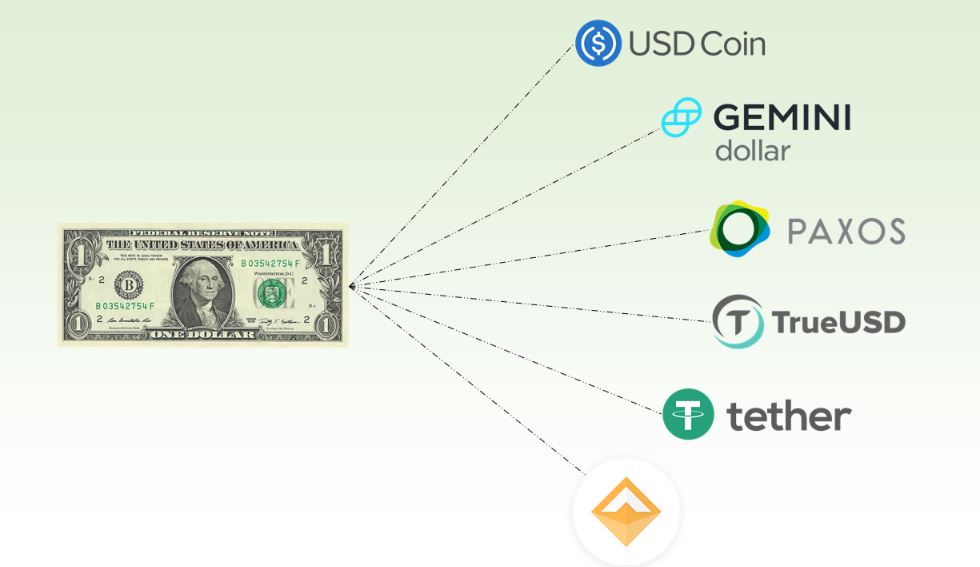

To understand how this works, we must comprehend the link between decentralized and centralized finance, which is a cryptocurrency that is linked to a real-world asset.

Stablecoins, such as Tether and USD Coin (USDC), are two example. This is due to the fact that their price is based on the US dollar.

Consider this: every time you buy a stable coin for $1, a new USDC is created. A USDC then gets burned every time you withdraw one, therefore the value of the coin is always worth one dollar.

The goal here is to provide a secure mechanism to buy and sell particular coins without having to buy and sell them yourself. We can simply exchange them instead.

Here’s an illustration of why this could be advantageous.

Let’s say you paid $500 for one Ethereum. Now its value is $1000, and you want to sell because you believe it’s high enough.

If you wish to cash out your gains without using stablecoins, you must sell your Ethereum to a centralized exchange such as Coinbase or Binance, and they will compensate you in US dollars. Of course, because they are also in business, they will take a percentage of the transaction as fees.

Furthermore, the IRS requires you to pay tax on any profits you generate from trading or selling. As law abiding business, Coinbase and other centralized exchanges may have to report you, so there’s no way around it.

The next step would be to wait for Coinbase or Binance to send them to your bank, then withdraw them because you don’t want the bank to have authority over your money. After a month, Ethereum has dropped to $250 and you want to purchase more, so you deposit your $1000 back into Coinbase.

Wait a few days for the transaction to clear before buying Ethereum and holding it. So, when Ethereum reaches $500, you decide to sell, and you do so through your centralized exchange. You take the charge and wait a few days for it to appear in your bank account.

As you can see, there are a lot of expenses in this case. There are taxes to pay and time to wait.

Now, let’s say you’re using a stablecoin like USDC. You purchased one Ethereum for $500, and it has now increased to $1000.

You trade your one Ethereum for 1000 USDC instead of going through all that trouble. And you only keep it for a month. The price drops to $250, and you swap your $1,000 USDC for 4 Ethereum.

Just as it did in the previous case. It then rises to $500. And here’s the best part: you can sell your 4 Ethereum for $2000 in less than five minutes. The fees were less than 1% because you traded on a decentralized exchange. And you were able to swap practically instantaneously as a result of it.

Plus, because it’s just code, the USDC was safe and you trusted it. It’s not going to change. Unlike Coinbase, Binance, and Gemini, which are regulated by the government and, more crucially, people..

Stablecoins were created for this reason.

You can participate in the cryptosphere without utilizing a government-owned bank most of the way.

In the US for example, any transaction above $10,000 must be verified and approved by a bank. Meanwhile, for just $5, using a stablecoin like USDC, you may move $10 million from one address to another without anyone blinking.

2. Lending and borrowing

Lending and borrowing are another crucial component of decentralized finance. Indeed, lending and borrowing money makes up a large portion of our current financial reality, thus it seems sense that the blockchain could do it better.

One of the reasons we can rely on banks to lend and borrow is that we normally put something down as collateral, such as physical assets, and can even be required to raise a certain percentage. Not repaying a loan has legal ramifications, including asset seizure or even jail time.

This is a problem with crypto because anonymity is one of its key tenets. In theory, you could put down 20% and walk away with the remainder of the loan. You will never be seen again. Because of this, a practical solution had to be devised.

We can utilize smart contracts to allow others to use our funds while still maintaining control over them.

Smart contract: Blockchain programs that run when predetermined conditions are met, automating execution of an agreement so that all participants can be immediately certain of the outcome.

Here’s an illustration. John wants to earn interest on his coins, and Mary wants to borrow coins, so they go to a platform like Compound, which allows crypto borrowing and lending.

John then places his coins in a smart contract.

As a result, he receives what’s referred to as C or A tokens, which are a representation of his original coin plus interest.

He can then turn these A or C tokens into the smart contract at any time, and they will spit out his initial deposit plus interest. Now, the smart contract is designed in such a way that no human being is required to perform the calculation or transaction.

It’s completely automated by code, so John can earn interest by lending in the typical way, but Mary must do something referred to overcollateralize her loan. In short, make a security deposit on her loan.

This means that if she wants to borrow $100, she will have to put down $120. So if she flees and never repays her loan, the smart contract is built in such a way that it can pay John his coins plus interest.

You might be thinking at this point, “What’s the sense of obtaining a loan if you already have the money?”

So, you have ten ETH worth $1000 because they’re each worth $100, but you don’t want to sell them because you really believe in the Ethereum concept. As a result, you pledge them as collateral and borrow $800 in Tether, a stablecoin pegged to the US dollar. So you trade that $800 about, making some money, losing some money, and then making some more.

It’s now time to repay your loan. So you have $850 in Tether and you repay the original $800 loan in order to reclaim your 10 Ethereum. With just a few deals, you made $50. But it’s also been a few months since you took the loan, and put your ETH as collateral. In that period, it has exploded in value, and they’re now worth $150 each. So now you have 10 ETH worth $150 each, giving you a total of $1,500 plus the $50 you earned from trading.

Basically, if you believe in Ethereum and own it but don’t want to sell it because you want to use its value, you may take out a loan against it in the hopes that it will be worth more when you pay it out.

If you traded, on the other hand, you might have lost some money, earned some money, and then lost some money again, ending up with $750 in tether. In this case, you’d have two choices.

First option is to pay the extra $50 up front to repay the entire debt and get back your Ethereum. This gets you back your 10 Ethereum, which would be the smart move if ETH has risen in value.

Second option is to keep the $750 and lose your 10 Ethereum. This could be smart if the ETH have lost value.

You may be interested in: What is an NFT Rug Pull?

Flash loans

In cryptocurrency, there is a second sort of loan known as a flash loan, which is a loan that lasts for about 10 seconds.

You could theoretically profit a dollar every time you bought an Ethereum for $10 on Coinbase and then sold it for $11 on Gemini. As a result, you can take out a “flash loan” to borrow millions of dollars. You are not required to pay any money. You’ve just written a $10 million fast loan. You tell it to go out and buy ETH for $10, then sell it for 11.

Then you repay the original loan of $10 million with a single little smart contract that runs in 10 seconds.

In other words, you made a million dollars minus the fees you had to pay to borrow the money. However, these fees are low because the lender knew you would have to repay them and that the loan was just for a limited time.

This is a more complex strategy, but something that is entirely not possible in traditional finance.

3. Decentralized Exchanges (DeX)

The 3rd pillar in DeFi is Decentralized Exchanges (DEX).

To illustrate this, we have a person who has traveled to Berlin from New York. In Germany, the currency is the Euro, whereas in the United States, it is Dollars.

So, of course, he went to a foreign exchange station to exchange his dollars for Euros. Unfortunately for him, the fees were approximately 12%. In short, the simple act of exchanging dollars for euros wiped out 12% of the value of his money.

When it comes to decentralized finance, a decentralized exchange takes the spot of a forex dealer.

Here, you can swap your coins and tokens for others. The fees are now typically quite low, such as less than half a percent, which is a huge benefit for anyone who wishes to trade their crypto assets on a regular basis.

The most prominent decentralized exchanges, or DEXs, work by pooling investor funds and then allowing traders to trade that money.

Every trading fee goes back to those investors, and it’s all done in code, so it remains standard, unlike with Forex dealers and banks where there are new rates every day.

Decentralized exchanges further make it possible to trade a wider range of tokens and currency.

Because they are regulated by the government and must adhere to many restrictions, Coinbase, the first centralized exchange to go public, currently only allows you to buy and sell about 50 cryptocurrencies. To incorporate a new coin, there is a long bureaucratic process, and many never see the light of day.

Uniswap, the most popular decentralized exchange, meanwhile thousands of tokens to trade, and they are completely unregulated. They are also self-listed, meaning you can create a cryptocurrency and list it there right now.

That’s where the decentralization comes in. Traders can trade because billions of dollars are tied up in these liquidity pools, yet no one has control over these billions of dollars. They’re simply following a program that was written by someone else.

In truth, only investors have the ability to withdraw funds from the pool, and if they did so, lending rates would climb, attracting new investors to put their money in.

The code is referred to immutable, meaning it cannot be changed.

The code is the law. It is not under the control of any government. It is also visible to everyone.

4. Insurance

Insurance is the 4th pillar in Decentralized Finance. It is a relatively simple concept to grasp.

For example, to safeguard your new car, you spend $120 each month in auto insurance. However, one day while not paying enough attention on the road, you crash into a barrier and completely wreck the car.

Since you paid for insurance, the insurance company will reimburse you for the value of the car, allowing you to purchase a new one.

The insurance companies utilize statistics to anticipate how many drivers will crash their cars, and then use that information to estimate how much they will have to pay out each year in order to establish what the insurance monthly premium should be per car model.

With DeFi, the insurance company is replaced with code.

Let’s look at a different scenario. Imagine a farmer wants to purchase crop insurance so that even if his crops fail, he will still be compensated for planting them and incurring the risk.

On a blockchain network, we could develop a piece of code that says “if there is any time this summer when it is 100 degrees Fahrenheit or above for 5 days in a row, pay farmer A $100,000.

He must, however, pay $5000 to begin this arrangement. So Farmer A can get crop insurance using a smart contract, which is simply code that checks to see if the criteria for payment are met.

Using things called Oracles, we can connect the real world to the blockchain. These are simply trusted bridges, such as connected weather instruments in this case. Their readings can even be verified by actual people to ensure accuracy and reliability.

The $100,000 to pay farmer A comes from the pool of other farmers who purchased crop insurance and paid premiums, but whose conditions for a payout were not met.

People that supply liquidity to any decentralized finance platform may be compensated with an interest rate to earn on their deposit, similar to how an insurance firm generates money.

A portion of the $100,000 may also come from investors who profit by lending their money for an interest.

5. Margin Trading

Margin trading is the final pillar of Decentralized Finance.

In the traditional financial system, this is how margin trading works.

So you want to buy Amazon stock, which is currently trading at $100. Margin is simply a loan that will automatically sell your shares if it falls below your down payment. So, to buy the stock, you require a $100 loan.

A bank agrees to provide you with that amount if you provide a $20 down payment and a tiny annual fee of 5%.

So, here are two possible outcomes. The price of the stock rises from $100 to $150. You decide to sell the shares and make your profit, and you receive $150.

You repay $80 of your loan because the bank already had your original $20 down payment, and you pocket the remaining $70 profit.

In other words, you made $70 by spending only $20. Even if the stock only went up 50%, this implies you more than tripled your money.

This is where the strength of the margin comes into play. You utilize the strategy to multiply your own money when you believe something will appreciate in value.

Let’s take a look at a different scenario. In this case, the stock price drops to $50.

With margin, you must sell as soon as the value of what you acquired is insufficient to repay your loan,

So in this case, immediately the Amazon stock price drops to $80, the bank forces you to sell it. So the $80 you made from selling the stock, plus the $20 you put down as a down payment, equalizes the loan, and the bank now has its original $100. So you’re debt-free after repaying your loan, but you didn’t make any money, but instead lost the $20 you put down as down payment.

To trade on margin in a centralized system, you must also normally be able to confirm your identity. To even get access to margin trading, you must have a minimum of a few thousand dollars, and the fees will be quite high.

In DeFi, margin trading follows the same concept, but you don’t need a huge starting capital, you can do it from any part of the world without proving your identity, and the process is much quicker and safer.

Follow us on Twitter @EverydayNFTnews for the latest NFT updates